Irs Schedule Se 2024 Self-Employment Tax – This year’s tax filing numbers are starting to catch up to 2023’s statistics — with average refund amounts up over 2023. . A type of payroll tax known as FICA funds a significant portion of these programs. Here’s a closer look at the FICA tax rate, what your employer pays and how that can change if you’re self-employed. .

Irs Schedule Se 2024 Self-Employment Tax

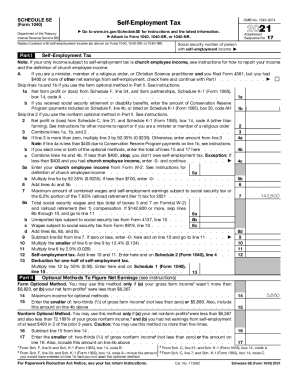

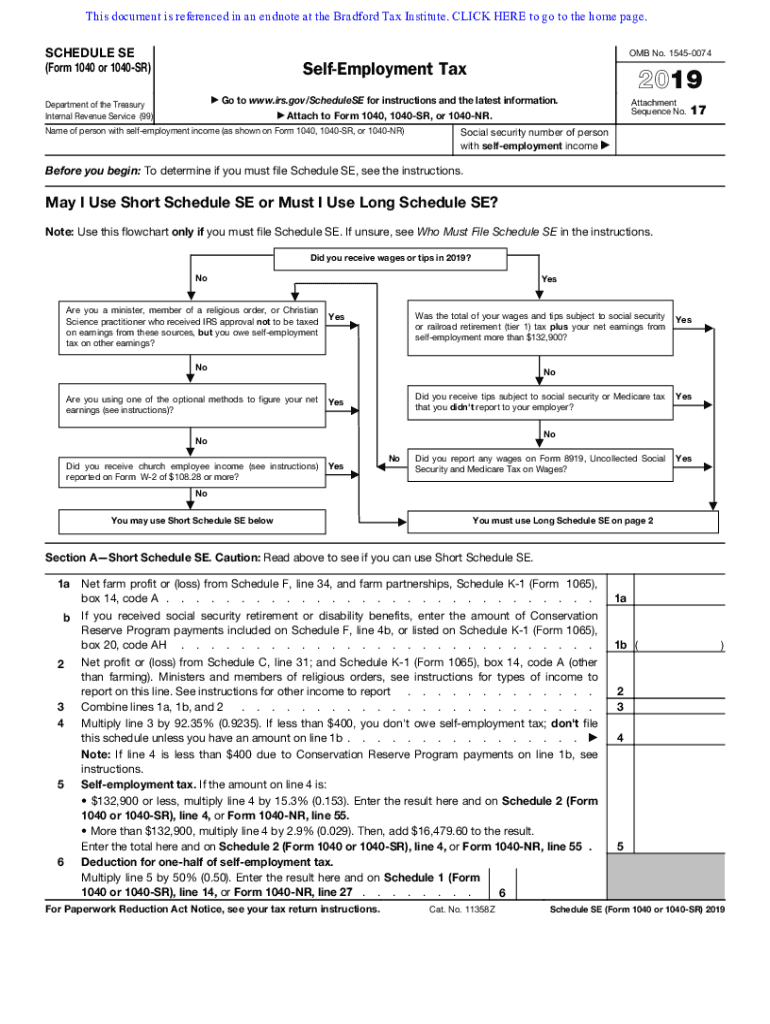

Source : www.pdffiller.comAbout Schedule SE (Form 1040), Self Employment Tax | Internal

Source : www.irs.govThe Complete Guide to the SETC | The 1st Capital Courier

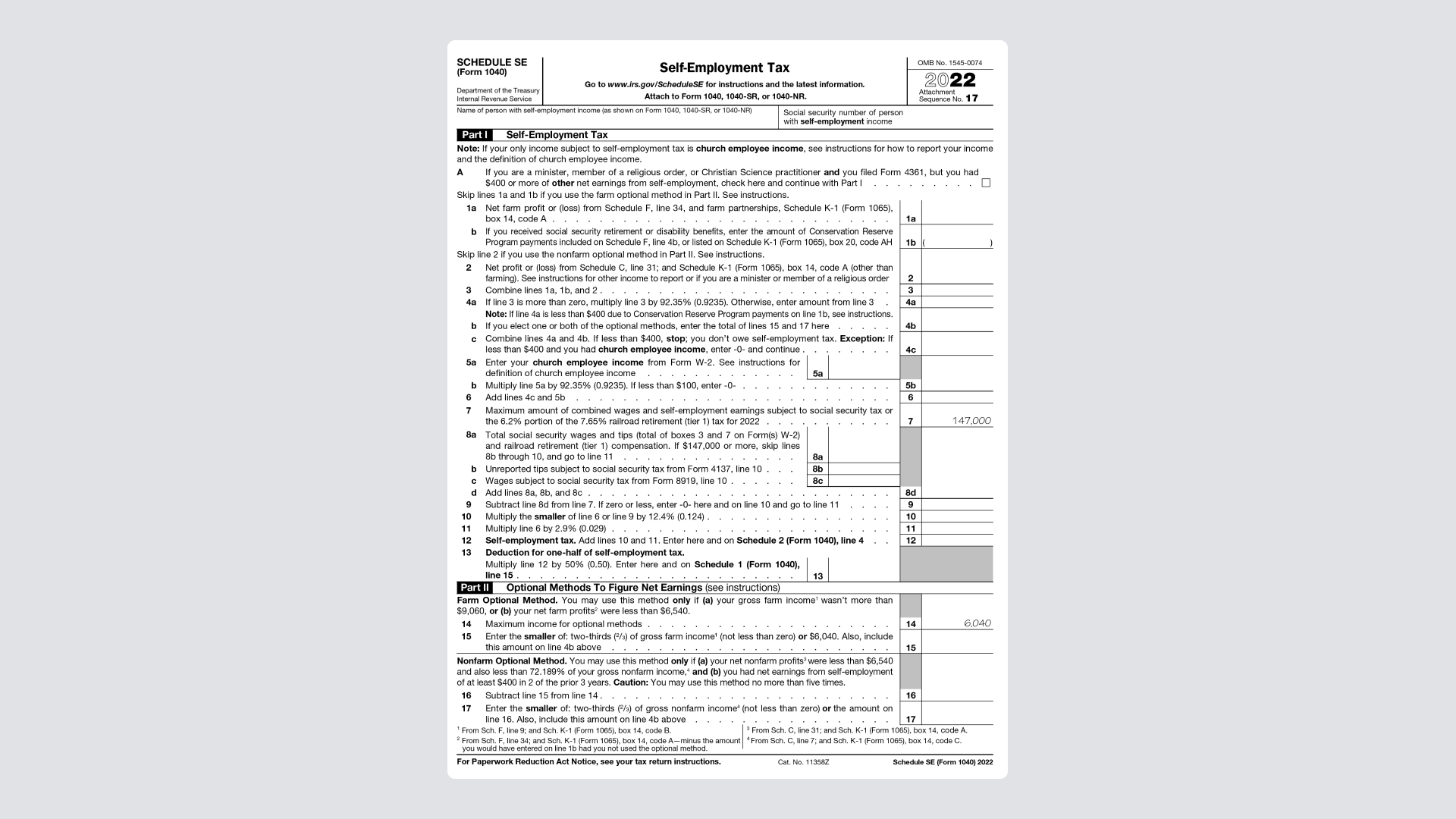

Source : 1stcapitalfinancial.com1040 (2023) | Internal Revenue Service

Source : www.irs.govA Step by Step Guide to the Schedule SE Tax Form

Source : found.comSelf employment tax form: Fill out & sign online | DocHub

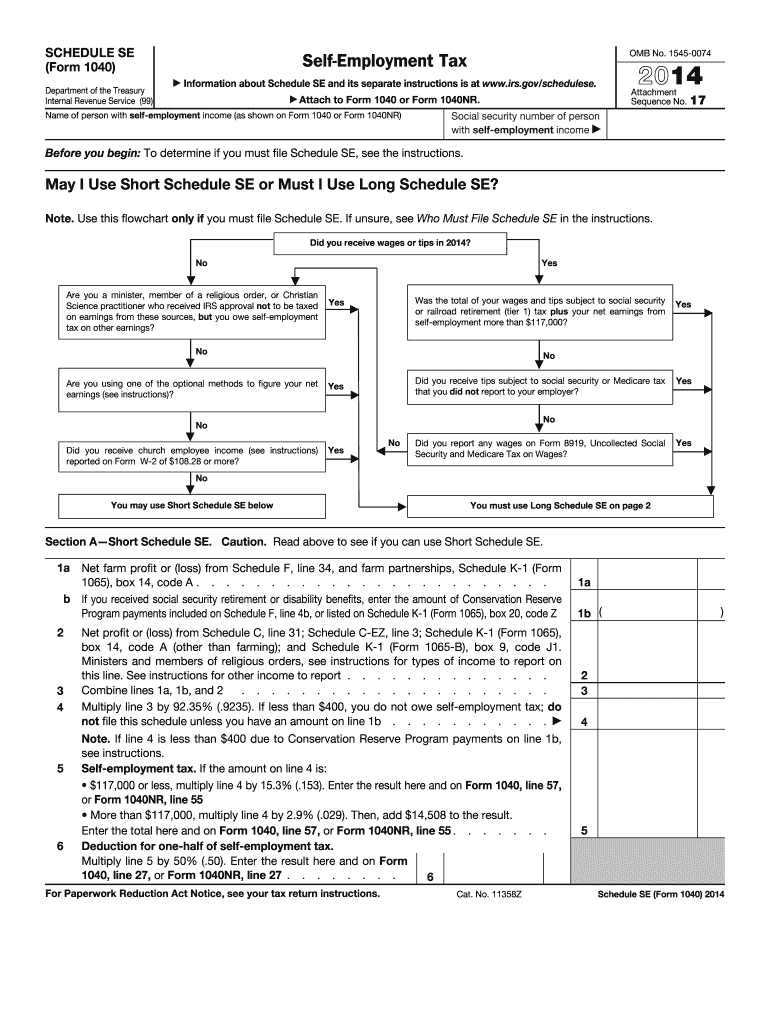

Source : www.dochub.comHow to File Self Employment Taxes, Step by Step: Your Guide

Source : www.keepertax.comSchedule se: Fill out & sign online | DocHub

Source : www.dochub.comPay Self Employment Tax | Expat US Tax

Source : www.expatustax.com2024 Tax Deadlines for the Self Employed

Source : found.comIrs Schedule Se 2024 Self-Employment Tax IRS Schedule SE (1040 form) | pdfFiller: If you made money last year from a side hustle or gig work, tax time can feel stressful and confusing. We’re here to help. This story is part of Taxes 2024 the IRS will treat nonemployee . The special March 1, 2024, deadline allows farmers and fishers to avoid any estimated tax penalties. Though several tax-payment options are available, a taxpayer can use a quick, easy and free option .

]]>